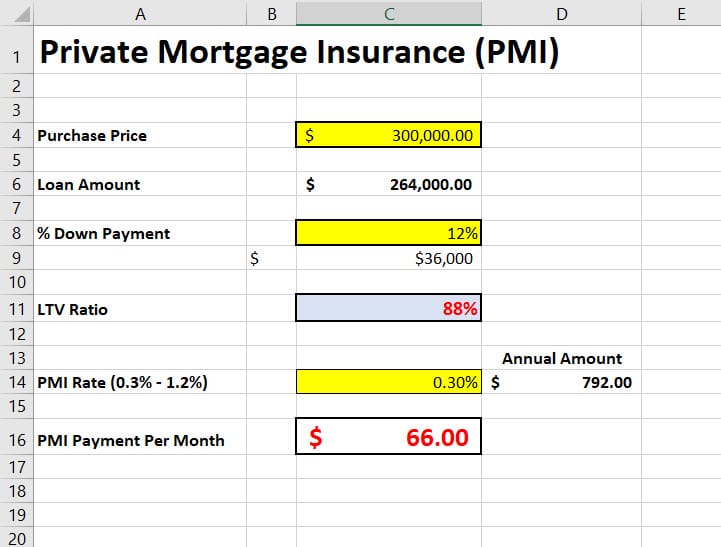

Learn how to calculate Private Mortgage Insurance (PMI) on a new home purchase. PMI is typically required when you have a conventional loan and put down less than 20% of the home’s purchase price. The PMI is required to determine your overall mortgage cost if required.

In order to begin, we must determine the Loan-to-Value (LTV) ratio. This takes the money you borrowed divided by the value of you property. Like most things in life, the higher the LTV Ratio, the higher your mortgage insurance will cost. Credit score and debt-to-income ratio are also considered. However, in this example we will keep them constant.

LTV Ratio = Amount of money you borrowed on the loan / Value of your property

Before you can calculate your PMI, you need to determine your mortgage insurance rate. These typically vary from 0.3% – 1.2% of the original loan amount per year. These rates are published by your mortgage lender and updated frequently. We will use .3% in our example, but you can manipulate the downloaded demo file accordingly.

In our example, our loan amount is $264,000, or 12% of the purchase price. Our LTV ratio is 88% (Credit score and debt-to-income not accounted). The PMI rate from our lender is .3% of the loan amount, which is $792.00 year, or $66.00 a month. This PMI number can be added to the Mortgage Calculator.

Once you are able to get your LTV ratio to 80%, or 20% equity, you can request to have your PMI insurance removed. This is why it is critical to put at least 20% down on any new home purchase.