Reverse Compound Annual Growth Rate is a calculation to determine the future value of your investment. In this calculation, the Compound Annual Growth Rate (CAGR), which is the mean annual growth rate of an investment over a specified period of time, is known.

Syntax:

FV = SA * (CAGR / 100 + 1) n

- FV – Final Amount/Future Amount

- SV – Starting Amount/Value

- CAGR – Compound Annual Growth Rate

- n – number of years the money is invested for

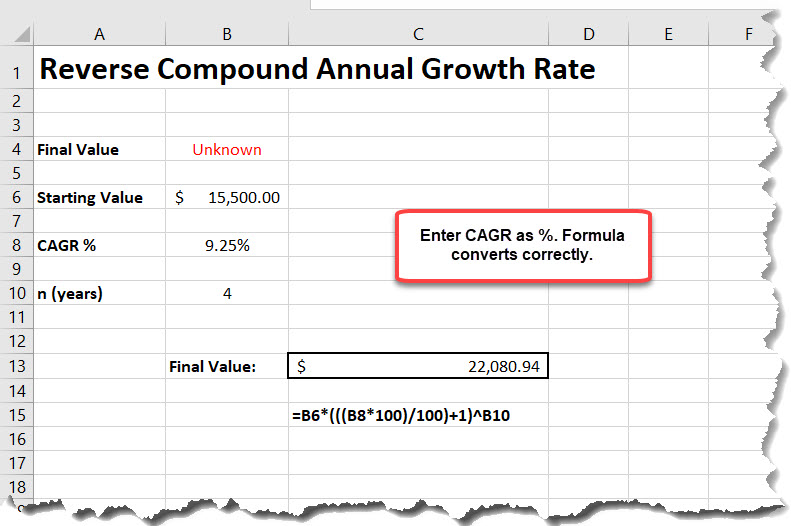

Reverse Compound Annual Growth Rate (CAGR) Example

Let’s calculate a Reverse CAGR. In our example, we know that our CAGR over 4 years is 9.25%. We use the following formula to calculate the final value.

=B6(((B8100)/100)+1)^B10 FV - Unknown SV - $15,500 CAGR - 9.25% n - 4 years